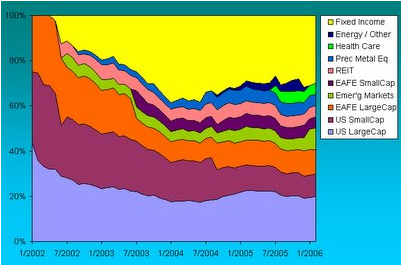

Recently, I generated an interesting chart showing how my asset allocation has evolved since 2002. I started out with a 100% equity allocation, being modelled along Larry Swedroe’s two parts of “value” equity to one part of “blend”, and with roughly equal allocations to US large-cap, US small-cap and International equities. Subsequently, I added REIT, emerging markets and precious metal equity asset classes. These asset classes proved to be life-savers for my portfolio. I have also abandoned the 2:1 value to blend ratio to simplify matters and to reduce the number of funds I need to hold.

My current target allocation is 70% equity and 30% fixed income, with the following breakdown:

US large cap 20%

US small cap 10%

EAFE large cap 10%

EAFE small cap 5%

Emerging markets 10%

REIT 5%

Precious metal equity 5%

Healthcare 5%

Fixed income 30%

I also used to have about 5% allocation to energy and individual stocks. But with the huge run-up in energy prices last year, I decided to close out the allocation and re-allocate the money. These go mostly into the now enlarged emerging market equity allocation.